The Role Of Bonds In Risk Management

You may not realize that there are various types of investment securities beyond stocks and mutual funds. These other options can be a great way to diversify your portfolio and manage risk. Bonds, for example, offer a fixed income stream, making them a popular choice for investors seeking stability. But what exactly are bonds?

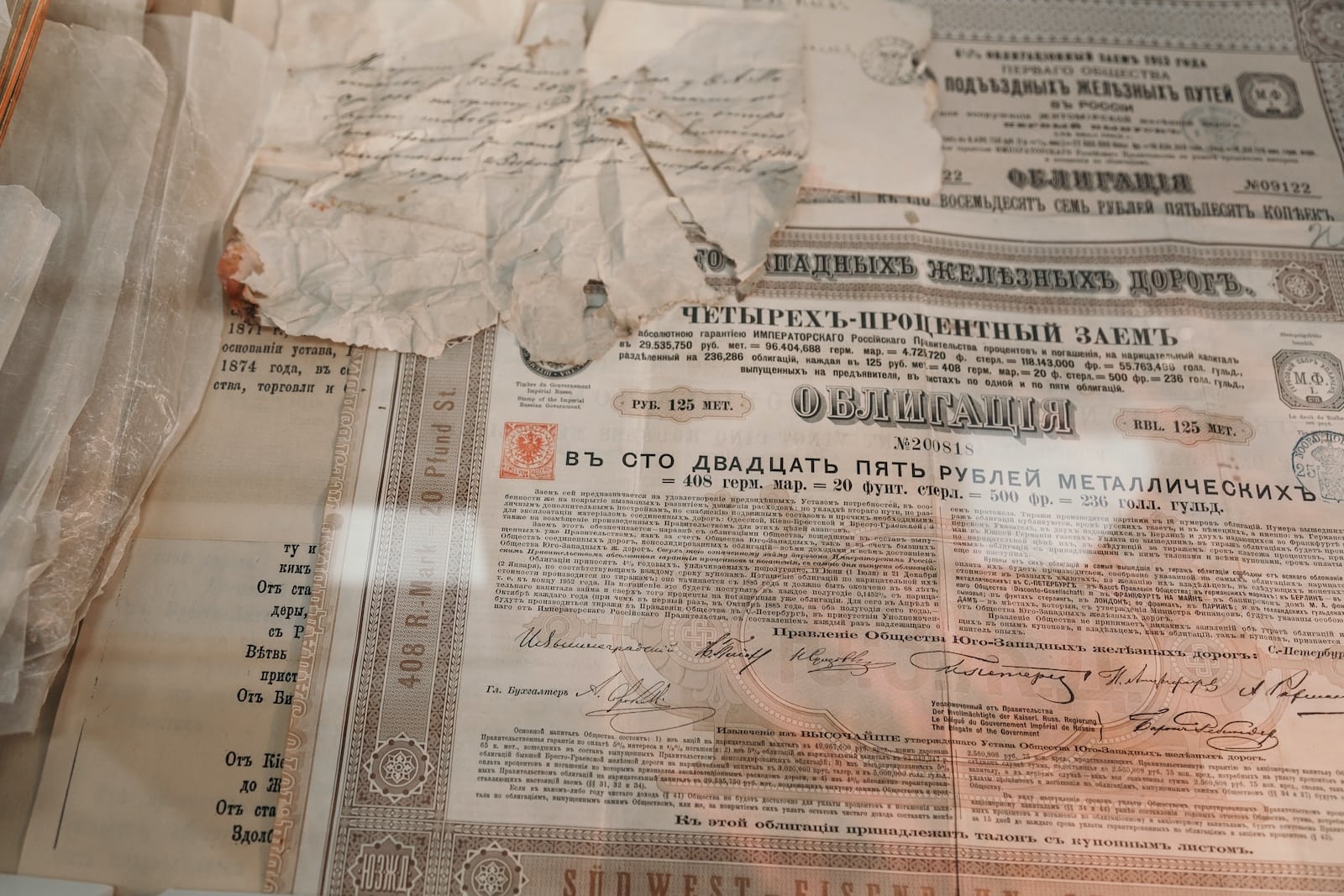

Simply put, bonds are debt securities issued by companies or governments to raise capital. When you invest in a bond, you're essentially loaning money to the issuer who promises to pay you back with interest over time. Bonds come in many different forms including treasury bonds, corporate bonds, municipal bonds, and high-yield (or "junk") bonds. Each type has its own level of risk and reward.

To better understand the differences between these bond types, let's take a look at this table:

| Type of Bond | Risk Level | Potential Return |

|---|---|---|

| Treasury | Low | Low |

| Corporate | Moderate | Moderate |

| Municipal | Low-Moderate | Low-Moderate |

| High-Yield | High | High |

As you can see from the table above, each type of bond carries its own level of risk and potential return. Treasury bonds are considered the safest option as they are backed by the U.S government while high-yield (or "junk") bonds carry more risk but also have the potential for higher returns.

Overall, understanding the various types of investment securities is crucial when it comes to managing risk in your portfolio. By diversifying your investments across different asset classes such as stocks and bonds with varying levels of risks and rewards, you can create a well-rounded portfolio that aligns with your financial goals while minimizing potential losses.

The Benefits of Bonds in a Portfolio

Adding bonds to your investment portfolio can provide stability and a consistent source of income, making them an attractive option for investors seeking long-term financial growth. While stocks may offer the potential for higher returns, they also come with greater risk.

Bonds, on the other hand, are typically less volatile and provide a fixed income stream that can help offset any losses in other parts of your portfolio. One of the main benefits of bonds is their ability to act as a hedge against inflation.

Inflation erodes the purchasing power of money over time, which can be detrimental to your investments. However, by investing in bonds that offer a higher yield than current inflation rates, you can protect yourself from this erosion while still earning a steady stream of income.

Another advantage of adding bonds to your portfolio is their diversification benefits. By holding both stocks and bonds in your portfolio, you can spread out your risk across multiple asset classes. This means that if one part of your portfolio performs poorly or experiences volatility, you have other assets that may help offset those losses.

Lastly, bonds often perform well during times of economic uncertainty or market downturns. When equities are performing poorly due to economic conditions such as high unemployment or low GDP growth rates, investors tend to flock towards safe-haven assets like government bonds. This flight-to-quality phenomenon helps drive up bond prices and provides investors with a buffer against any potential losses in other areas of their portfolios.

Adding bonds to your investment portfolio can provide stability and diversification while also protecting against inflation and market downturns. While they may not offer the same potential for high returns as stocks do, including them as part of a well-rounded investment strategy can help ensure long-term financial growth and security.

How Bonds Provide Stability and Predictability

When it comes to building a secure financial future, it's important to understand how bonds can offer stability and predictability in uncertain times. Bonds are essentially loans made by investors to organizations that need funds for various purposes. When you invest in bonds, you receive regular interest payments over the life of the bond, and at maturity, you receive your initial investment back.

Here are four ways that bonds provide stability and predictability:

Low volatility - Bonds generally have lower volatility than stocks because they have a fixed coupon rate and maturity date. This means that even if the market fluctuates significantly, your bond will still pay out its expected return.

Diversification - Adding bonds to your portfolio can help diversify your investments and reduce overall risk. This is because when stocks perform poorly, bonds often perform well (and vice versa).

Income stream - If you're looking for stable income streams during retirement or another period of limited earning potential, investing in bonds can be a good option. Bonds typically pay higher interest rates than savings accounts or CDs.

Predictable returns - With most types of bonds, you know exactly what your return will be before investing. This allows you to plan ahead and make informed decisions about your portfolio.

Overall, while bonds may not offer the same high returns as other types of investments like stocks or real estate, they do provide an important element of stability and predictability that can help mitigate risk in uncertain times. By including them in your portfolio alongside other assets, you'll be better positioned to weather any economic storms that may come your way while still achieving long-term financial goals like saving for retirement or funding a child's education.

Hedging Against Inflation with Bonds

Protect your investments from inflation by investing in bonds, which can provide a hedge against rising prices. Inflation refers to the general increase in prices of goods and services over time, reducing the purchasing power of money. While inflation may seem like a minor issue, it can have significant impacts on investment portfolios. Bonds are an excellent way to protect against inflation as they offer fixed interest rates that do not change with inflation.

Inflation-protected bonds or Treasury Inflation-Protected Securities (TIPS) are one option for investors looking to hedge against inflation. TIPS pay a fixed interest rate plus an adjustment for inflation based on the Consumer Price Index (CPI). This means that if the CPI increases due to inflation, the bond's principal and interest payments will also increase accordingly.

Another option is corporate bonds issued by companies with pricing power. These companies can pass on any cost increases caused by inflation onto their customers through higher prices, thereby maintaining profitability. Investing in these types of bonds provides protection against both credit risk and inflation risk.

To better understand how different types of bonds perform during periods of high and low inflation, consider this table:

| Bond Type | Performance During High Inflation | Performance During Low Inflation |

|---|---|---|

| TIPS | Outperform | Underperform |

| Corporate Bonds | Perform well | Perform poorly |

Investing in bonds can be an effective tool for managing risks associated with inflation. By choosing appropriate bond types such as TIPS or corporate bonds with pricing power, investors can protect their portfolios from loss of value due to rising prices. It is important to note that while no investment is completely risk-free, understanding how different assets perform under varying market conditions is essential for building a diversified portfolio that meets your financial goals.

Types of Bonds: Government, Corporate, Municipal

You can diversify your portfolio by investing in different types of bonds, such as government, corporate, and municipal bonds. Each type has its own unique characteristics, offering varying levels of risk and reward.

Government bonds are often considered the safest option because they're backed by the full faith and credit of the government. These bonds come in various maturities ranging from short-term to long-term. The interest rates on government bonds tend to be lower than those of other bond types but provide a stable source of income for investors seeking a more conservative investment.

Corporate bonds offer higher yields than government bonds but also come with increased risk. These bonds are issued by corporations to raise capital and may have varying degrees of creditworthiness depending on the issuing company's financial health. Investors who choose corporate bonds must perform due diligence before investing to ensure that they receive adequate returns without exposing themselves to too much risk.

Municipal Bonds are issued by state and local governments or their agencies, raising funds for public projects such as schools, hospitals, or infrastructure improvements. Municipal Bonds typically offer tax advantages since they're exempt from federal taxes and state taxes in some cases. However, these benefits vary based on an investor's specific circumstances.

Diversifying your portfolio through different types of bond investments can help you manage risk effectively while providing a stable source of income. By understanding the characteristics and risks associated with each bond type – government, corporate, or municipal – you can make informed decisions about how to allocate your assets optimally within your portfolio.

Determining Your Risk Tolerance

Discovering your risk tolerance is crucial for designing a bond portfolio that aligns with your investment goals and personal preferences. To determine your risk tolerance, you must first understand what it means. Risk tolerance refers to the amount of financial risk you're willing to take in pursuit of achieving your investment objectives.

To determine your risk tolerance, consider the following factors:

- Investment Goals: What are you investing for? Are you saving for retirement or a down payment on a house?

- Time Horizon: How long do you plan to hold onto your investments?

- Financial Situation: What's your current income, and how much debt do you have?

- Personal Preferences: Are you comfortable with volatility, or would you prefer more stable returns?

- Emotional Tolerance: Can you handle short-term fluctuations in the market?

Once you've considered these factors, it's important to match them with appropriate bond investments. For example, if you have a low-risk tolerance and are investing for a short time horizon, government bonds may be a good fit as they offer lower returns but more stability. On the other hand, if you have a high-risk tolerance and are investing for the long-term, corporate bonds may offer higher returns but come with more volatility.

Determining your risk tolerance is an essential step in managing risk through bonds. By taking into account your investment goals, time horizon, financial situation, personal preferences, and emotional tolerance, you can create a bond portfolio that aligns with both your financial objectives and psychological comfort levels.

Remember that there's no one-size-fits-all approach when it comes to investing - what works for one person may not work for another. Take the time to assess where you stand on the risk spectrum before making any investment decisions.

Balancing Your Portfolio with Bonds

When it comes to diversifying your investments, adding bonds can help balance your portfolio. Bonds are a type of fixed-income security that allows you to loan money to an entity (such as a corporation or government) in exchange for regular interest payments and the return of your principal investment at maturity. This makes them a great way to offset the riskier components of your portfolio, such as stocks.

So how do you determine how much of your portfolio should be allocated towards bonds? The answer lies in understanding your risk tolerance and financial goals. A common strategy is to use age-based asset allocation, where the percentage of bonds in your portfolio increases as you get closer to retirement. Another approach is to use a simple rule-of-thumb formula like "age minus 10,"where you subtract 10 from your current age and allocate that percentage towards bonds.

To give you an idea of how different portfolios may be balanced with varying degrees of bond allocations, take a look at the table below:

| Portfolio | Stocks | Bonds |

|---|---|---|

| Aggressive | 90% | 10% |

| Moderately Aggressive | 70% | 30% |

| Moderate | 50% | 50% |

| Conservative | 30% | 70% |

As you can see, more conservative portfolios tend to have higher bond allocations while aggressive portfolios have more stocks than bonds. However, it's important to note that there is no one-size-fits-all solution when it comes to investing – what works for one person may not work for another.

Incorporating bonds into your investment portfolio can play an important role in managing risk and achieving financial goals. By understanding your own risk tolerance and using strategies like age-based asset allocation or simple formulas like "age minus 10,"you can make informed decisions about how much of your portfolio should be allocated towards bonds versus other types of investments.

Strategies for Investing in Bonds

Let's explore some savvy ways to invest in bonds that can help you diversify your portfolio and potentially earn steady returns.

When investing in bonds, it's important to consider the different types of bonds available, such as government bonds, corporate bonds, and municipal bonds. Government bonds are generally considered safer investments because they're backed by the full faith and credit of the government issuing them.

Corporate bonds come with a higher risk but also offer higher yields. Municipal bonds are tax-free but come with their own set of risks.

Another strategy for investing in bonds is to consider bond funds or exchange-traded funds (ETFs). Bond funds are mutual funds that invest primarily in fixed-income securities such as bonds. They offer diversification across a variety of bond types and maturities.

ETFs have become increasingly popular due to their low fees and ability to trade like stocks on an exchange.

When it comes to investing in individual bonds, it's important to do your research on the creditworthiness of the issuer before making any investment decisions. You can use credit ratings from agencies such as Moody's or Standard & Poor's to assess the risk level of a particular bond.

It's also important to consider factors such as interest rates, inflation, and market volatility when making investment decisions.

Lastly, it's important not to overlook the role that professional financial advisors can play in helping you navigate your bond investments. A qualified advisor can help you make informed decisions based on your specific financial goals and risk tolerance.

By working with a professional advisor, you may be able to achieve greater diversification and potentially earn higher returns while minimizing overall risk exposure within your portfolio.

Monitoring and Adjusting Your Bond Portfolio

It's crucial to regularly monitor and make adjustments to your bond portfolio in order to ensure that it aligns with your financial goals and risk tolerance. This means keeping an eye on interest rates, credit ratings, and economic trends that could affect the value of your investments.

The good news is that many online brokers offer tools and resources for monitoring your portfolio, including real-time market data and alerts.

When it comes to adjusting your bond portfolio, there are a few strategies you can use. One is called laddering, which involves investing in bonds with staggered maturities. For example, you might buy bonds that mature in one year, three years, five years, and ten years. This approach can help balance risk and return, as well as provide regular income from interest payments.

Another strategy is called barbelling. This involves investing in both short-term and long-term bonds but avoiding intermediate-term bonds. The idea behind this strategy is to reduce exposure to interest rate risk while still taking advantage of higher yields on longer-term bonds.

Ultimately, the key to successfully managing your bond portfolio is staying informed about market conditions and being willing to make adjustments when necessary. By doing so, you can help minimize risk while maximizing returns over the long term – all while achieving your financial goals in a way that aligns with your personal values and priorities.

Frequently Asked Questions

What is the minimum amount of money needed to invest in bonds?

If you're looking to invest in bonds, the minimum amount of money needed will depend on the specific bond you want to invest in. Some bonds may have a minimum investment requirement of as low as $100, while others may require thousands or even millions of dollars.

It's important to do your research and understand the terms and conditions before investing in any bond. Keep in mind that bonds can be an effective tool for managing risk within your investment portfolio, providing a steady stream of income and potentially reducing overall portfolio volatility. However, as with any investment, there are risks involved, so it's essential to weigh these carefully before making any decisions.

How do credit ratings affect the value of bonds?

Credit ratings play a significant role in determining the value of bonds. When issuers receive good credit ratings from rating agencies, it indicates that they are less likely to default on their payments. This translates into higher demand for their bonds, leading to an increase in bond prices and a decrease in yields.

On the other hand, low credit ratings suggest that there is a higher risk of default, resulting in lower demand for their bonds and higher yields. Therefore, it's crucial to pay attention to credit ratings when investing in bonds as they can significantly impact your returns and overall portfolio performance.

Can bonds offer higher returns than stocks?

Yes, bonds can offer higher returns than stocks in certain situations. Bonds are considered less risky than stocks because they pay a fixed interest rate and have a specific maturity date for repayment of the principal. This predictability makes them attractive to conservative investors who prioritize preserving their capital over taking risks for higher returns.

However, some bonds may offer higher yields if they're issued by companies or governments with lower credit ratings, as compensation for the increased riskiness of investing in these bonds. Additionally, bond prices tend to rise when interest rates fall, which can lead to capital gains for bondholders.

Ultimately, the decision between investing in stocks or bonds should be based on individual financial goals and risk tolerance levels.

What factors should be considered when choosing between government, corporate, and municipal bonds?

When choosing between government, corporate, and municipal bonds, there are several factors that should be considered.

Firstly, you need to determine your investment goals and risk tolerance. Government bonds are generally considered the safest option as they're backed by the full faith and credit of the government.

Corporate bonds may offer higher yields but come with a higher level of risk as they're issued by companies.

Municipal bonds can be tax-exempt and may be a good option for those in higher tax brackets.

Additionally, you should consider the bond's credit rating, duration, and yield to maturity when making your decision.

It's important to do your research and understand the risks associated with each bond before investing.

Is it possible for a bond to default, and what happens to the investor if it does?

Yes, it's possible for a bond to default, and if it does, as an investor, you may lose some or all of the money you invested.

A bond defaults when the issuing company or entity fails to make interest payments or pay back the principal amount on time. The likelihood of default varies depending on the type of bond and the issuer's creditworthiness.

Generally, corporate bonds carry a higher risk of default than government bonds because companies are more likely to face financial difficulties. To mitigate this risk, investors can diversify their bond portfolio by investing in a mix of government, corporate, and municipal bonds with varying maturities and credit ratings.

Additionally, doing thorough research on the issuer's financial health before investing can help minimize the risk of default.

Conclusion

Congratulations! You now have a better understanding of the role of bonds in risk management. By investing in bonds, you can add stability and predictability to your portfolio while hedging against inflation.

It's important to determine your risk tolerance and balance your portfolio accordingly with a mix of stocks and bonds. There are various strategies for investing in bonds, such as buying individual bonds or investing in bond funds.

It's also crucial to monitor and adjust your bond portfolio as needed to ensure it aligns with your investment goals and objectives. With careful consideration and planning, incorporating bonds into your investment strategy can help mitigate risk and potentially lead to long-term financial success.